How to Use Volume Oscillator to Boost Your Profits

309 Share 11K views 3 years ago How to thinkScript Learn how to build an Advanced VZO Indicator for ThinkOrSwim in 25 minutes. We'll cover everything, from reading ThinkOrSwim documentation to.

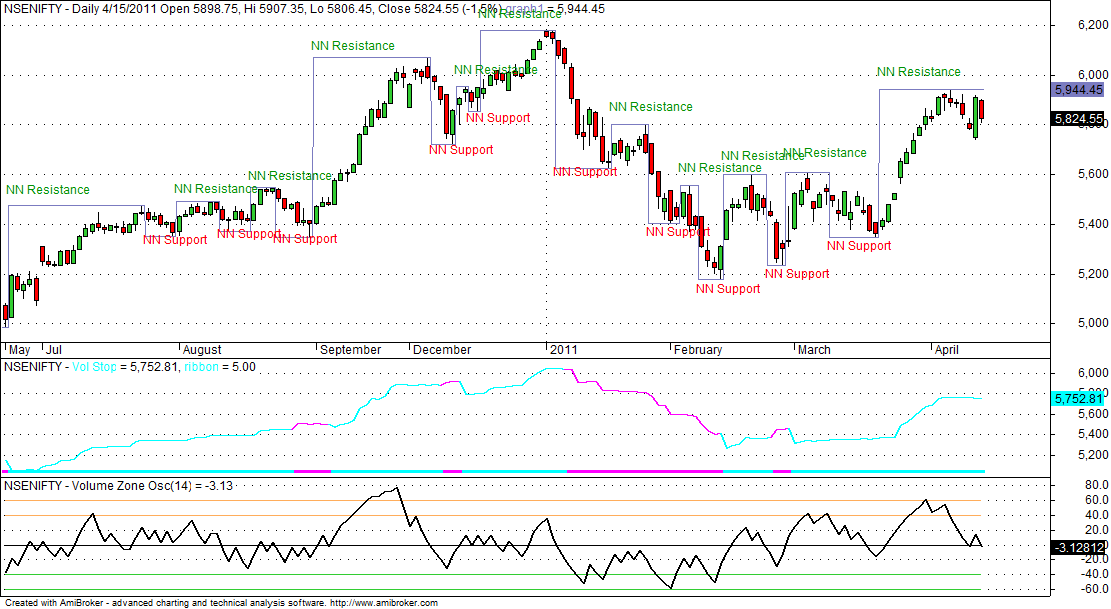

How To Trade In Equites ? VOLUME ZONE OSCILLATOR

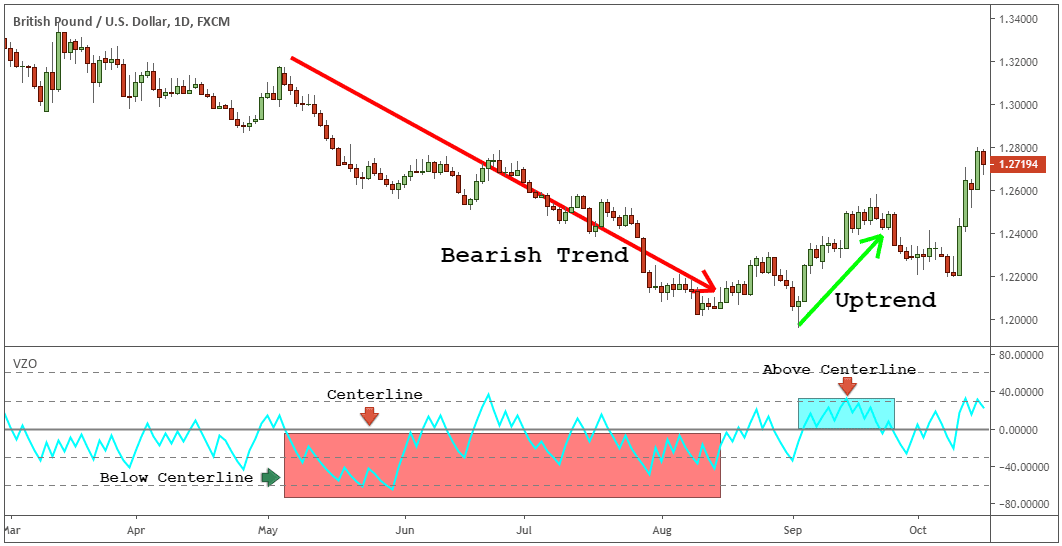

The Volume Zone Oscillator helps traders identify periods of high buying or selling pressure and can be used to confirm trends, spot divergences, and generate trading signals. By analyzing the relationship between volume and price, traders can gain a deeper understanding of market dynamics and make more informed trading decisions.

Images for Volume Zone Oscillator AFL pipschart

The volume zone oscillator Volume is simply the number of shares or contracts that have been traded throughout the day, so the higher the volume, the more active the security. Volume is always treated as a secondary indicator, despite its importance in confirming trends and chart patterns.

Trade theCatalyst a Pro with the VZO the Volume Zone Oscillator (My Favorite Indicator)

The Volume Zone Oscillator (VZO) is a technical indicator analyzing volume changes in relation to certain levels (zones). Unlike VolumeOsc, the VZO uses price data along with volume. Two averages are calculated for the VZO: the first one is price related EMA of volume, the second is general EMA of volume.

Free Download Volume Zone Oscillator indicator for Metatrader 5 Prof FX

The oscillator breaks up daily volume activity into positive and negative categories. It's positive when the current closing price is greater than the prior closing price and negative when it's.

Volume Zone Oscillator YouTube

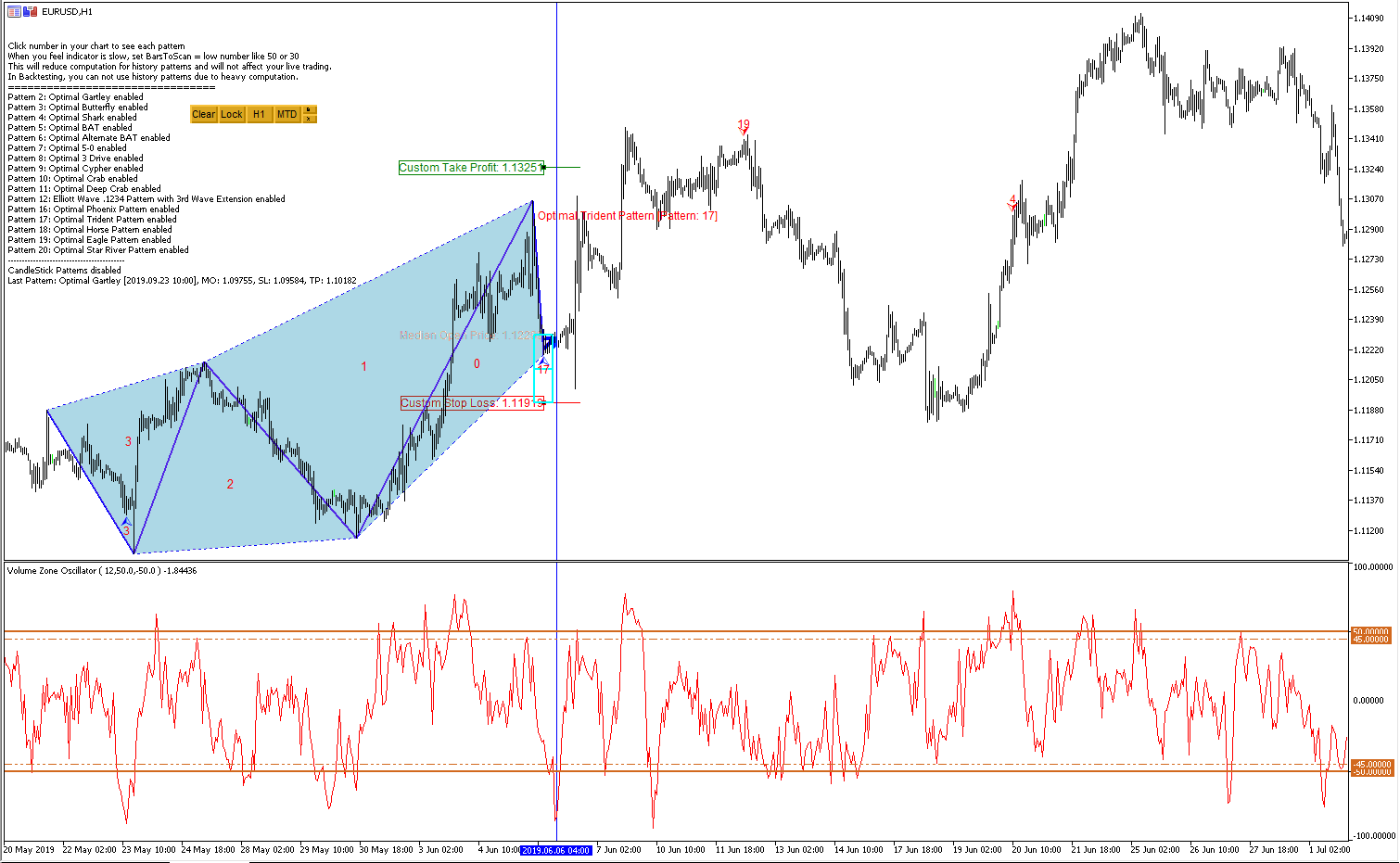

The Volume Zone Oscillator Formula: VZO = 100* (VP/TV) Where, VP = Volume Position = X- period EMA (+/- volume) TV = Total Volume =X- period EMA (volume) The period is 14 by default, however, it can be modified after backtesting.

How To Use Volume Oscillator To Boost Your Profits

Join Robinhood with my link and we'll both pick our own free stock 🤝 https://join.robinhood.com/davidn474 If you found value in the content I have created h.

How to Use Volume Oscillator to Boost Your Profits

The Volume Zone Oscillator (VZO) is a technical indicator analyzing volume changes in relation to certain levels (zones). Unlike VolumeOsc, the VZO uses price data along with volume. Two averages are calculated for the VZO: the first one is price related EMA of volume, the second is general EMA of volume.

How To Use Volume Oscillator To Boost Your Profits

Volume Zone Oscillator. The Volume Zone Oscillator (VZO) was authored by Walid Khalil and David Steckler in the Stocks and Commodities Magazine, May 2011. The VZO uses price, previous price and moving averages to compute its oscillating value. It is a leading indicator that calculates buy and sell signals based on oversold / overbought conditions.

Volume Zone Oscillator Fl ⋆ Top MT5 Indicators {mq5 & ex5} ⋆

In this video I explain how to find the highest probability trade possible using the Volume Zone Oscillator (VZO).-----.

Volume Zone Oscillator NT7 May 2011 S&C NinjaTrader Ecosystem

Volume Zone Oscillator, uses and formula https:www.investopedia.com/articles/active-trading/072815/how-interpret-volume-zone-oscillator.asp Price Zone Oscillator, uses and formula https:www.investopedia.com/terms/p/price-zone-oscillator.asp Release Notes: - Option to change the overly bright background fill (to light, dark or none)

Volume Zone Oscillator NT8 May 2011 S&C NinjaTrader Ecosystem

The volume oscillator displays the relative strength of a shorter volume moving average to a longer one. To keep things super simple, whenever there is a positive reading for the volume oscillator, there is strength on the short-term in the direction of the primary trend.

Volume Zone Oscillator • Free MT5 Indicators [MQ5 & EX5] Download •

Price Zone Oscillator: The Price Zone Oscillator is a technical indicator that measures whether the most recent closing price is above or below the preceding price.

Harmonic Pattern with Volume Zone Oscillator Trading Systems 6 May 2020 Traders' Blogs

The volume oscillator consists of two moving averages of volume - one fast and one slow. The fast volume moving average is then subtracted from the slow moving average. The volume oscillator could be useful to any technical trader's toolbox. Analyzing volume gives traders another viewpoint for analyzing potential trades.

Volume Oscillator Indicator Basic Strategy, Settings StockManiacs

Volume Zone Oscillator The Price Zone Oscillator measures if the most recent closing price is above or below the preceding closing price. Like most oscillators signals are generated when stocks reach overbought or oversold extremes. The oscillator moves higher when the daily factor has a positive value and lower when it has a negative value.

:max_bytes(150000):strip_icc()/dotdash_INV-final-How-to-Interpret-the-Volume-Zone-Oscillator-May-2021-01-31301b3d1a864ed89ecf143ad6dc2216.jpg)

How to Interpret the Volume Zone Oscillator

The volume oscillator indicator calculates a fast and slow volume moving average. The difference between the two (fast volume moving average minus slow volume moving average) is then.